The Best Portfolio Analyzer App

Unlock analytics on your investment portfolios

Know more about your portfolios

Trusted by investors in over 160+ countries

Track and analyze your portfolios

See all of your investments in one place at Portseido with 70+ stock markets all over the world, cryptos and etfs, track your performance correctly and analyze your portfolio to have better insights on your investments and get ready for the future.

How Portseido Portfolio Analyzer helps?

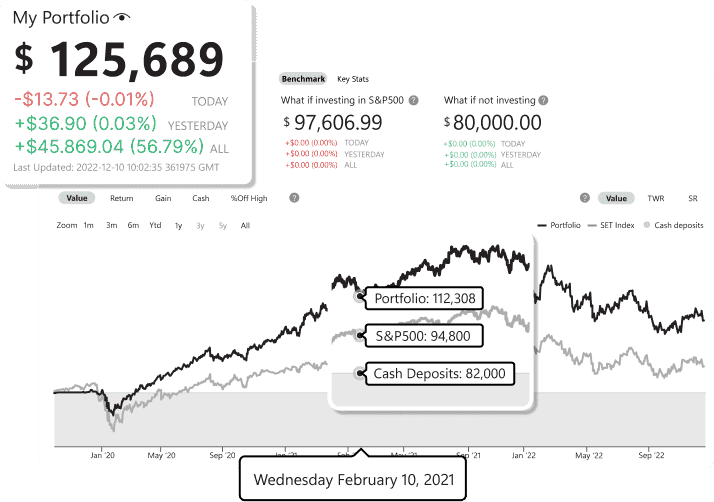

Measure and benchmark your performance

Easily track and compare your performance against benchmarks of your choices using Money-Weighted Return (MWR), Time-Weighted Return (TWR), Simple Return and other risk metrics.

Analyze your allocation

Aggregate multiple portfolios into one view and monitor how your portfolio is allocated across multiple stocks, asset classes, industries, sectors and see how your portfolios stack up.

Watch out for your portfolio risks

Analyze your portolio drawdown and monitor portfolio beta, max drawdown duration, sharpe ratio & more.

Dig deeper into why

From your portfolios to your positions to each of your trades, you know exactly where the returns came from, so you can invest with more confidence.

Meet investors who choose Portseido

Investors all over the world analyze their portfolios with Portseido.

How portfolio analysis tool works?

Simply input the trades you made via our intuitive interface or by uploading a file containing your trade history. Once Portseido has data on your past trades, you are set to analyze all your portfolios in various aspects, historical performance, trade analytics, allocations and many more. Our goal is to empower you to answer all the questions you have about your own portfolio. Check out our help center on the specifics of how to get set up.

How to Portseido portfolio analyzer measure your performance?

As an investment portfolio analysis tool, Portseido offers a full picture of portfolio performance to all investors. In addition to the price fluctuations, Portseido automatically includes foreign exchange rate gains, dividend incomes, brokerage fees and withholding taxes into the calculation. Furthermore, Portseido offers a wide range of performance metrics including simple return, time-weighted return, money-weighted return, beta, drawdown and much more

How to benchmark investment portfolio performance?

As an investor, opportunity cost is the true cost of investing. It is the foregone benefit from choosing to invest in one alternative over another. To track this cost over time, investors have to bemchmark their performance. Portseido can help simplifying the process by automatically benchmarking the investment portfolio performance to major indices and ETFs around the globe.

Can I import my trade history from my Brokerage?

Absolutely! Portseido supports file formats from major brokerages - DEGIRO, Trading 212, TD Ameritrade, Charles Schwab, M1 Finance, Fidelity, Freetrade, Interactive Brokers, Hellostake, Questrade, Vanguard, Nabtrade, Zerodha, Selfwealth, Revolut, RBC Direct, XTB, City National Bank, eToro, Webull, E*TRADE, SAXO, JP Morgan Chase, Firstrade, FlowBank, Superhero, Robinhood, Raiz, SoFi, CMC Markets, DriveWealth, Lightyear, TIAA, LHV, Sharesies, LYNX, TradeStation, Merrill Edge, National Bank Direct Brokerage, Justwealth, Invest Engine, CommSec, Avanza, Nordnet, Moomoo, Tiger Brokers, InnovestX, Bell Direct, Freedom24, Portu, Groww, Desjardins, Bux, Wealthsimple, Trade Republic, Citi Self Invest, Swissquote, Directa, BMO, Qtrade, Scalable Capital, Hatch Invest, Pearler, Interactive Investor, TradeVille, Patria Finance, Ally Invest, tastytrade, finanzen.net ZERO, FFB, Westpac, True Wealth, betashares, Morgan Stanley, Fineco Bank, Wells Fargo, ICICI Direct, AJ Bell, Guotai Haitong, KLP, Kasikorn Securities, Balanz. Don’t see your brokerage on the list? You can send us a request to support your platform! In addition, you can also upload your data from other applications too such as Yahoo Finance, Google Finance and Portfolio Performance app