What Is Financial Independence, Retire Early (FIRE)?

Financial Independence, Retire Early or FIRE is a financial and lifestyle movement that encourages individuals to save aggressively and invest to achieve financial independence and retire early. The core idea behind FIRE is to accumulate enough wealth that the followers of the movement can live off the desired lifestyle from the wealth accumulated.

How Does FIRE Work?

Two key components of FIRE are saving aggressively and investing wisely. By starting saving your income early and investing the sums, compound interest can accelerate the journey to Financial Independence and Retire Early.

FIRE Types

FIRE is commonly classified based on the goals and the way to reach them. Here are 3 well-known types of FIRE:

1. Fat FIRE

Those who follow the Fat FIRE approach aim to at least maintain their current lifestyle while saving more than the average person. This means they do not sacrifice their spending habits but ensure that they can sustain this lifestyle in retirement without relying on traditional employment income. For Fat FIRE followers, you can try out our Fat FIRE Calculator .

2. Lean FIRE

Lean FIRE is about living a simpler life and spending less money. By cutting out unnecessary expenses, you can save more and retire early. For Lean FIRE followers, you can try out our Lean FIRE Calculator .

3. Barista FIRE

Barista FIRE combines early retirement with part-time work. Those pursuing Barista FIRE aim to save aggressively to the point where they can live off their investments while working part-time or pursuing lower-stress, more enjoyable jobs. For Barista FIRE followers, you can try out our Barista FIRE Calculator .

4. Coast FIRE

Coast FIRE is a bit different approach from other types of FIRE but is kind of similar to Barista FIRE. Coast FIRE is a movement where you save aggressively earlier to the point where you don't have to save nor withdraw from your investments later before full retirement since the power of compounding will take care of itself. With Coast FIRE, the emphasis is on achieving a level of financial independence that allows individuals to step back from high-stress, high-paying jobs without fully retiring. This unique approach grants the freedom to work in roles that may offer lower compensation but are personally fulfilling or less demanding. By no longer requiring aggressive saving, individuals can embrace a more balanced lifestyle, opting for jobs that align with their passions or provide a better work-life equilibrium. For Coast FIRE followers, you can try out our Coast FIRE Calculator .

How to use our FIRE calculator?

In the journey toward financial independence, having a tool that can help you visualize your goal clearly and work toward your financial goal with more clarity is invaluable. Portseido's Free Online Fire Calculator is one such tool that empowers individuals to plan for their financial independence and retire early. We will explore how to effectively use this calculator to project your financial future, set realistic goals, and make informed decisions.

Understanding the Inputs:

1. Time Horizon (Years):

This is the duration over which you plan to achieve your financial goals. Whether you're aiming for early retirement or saving for a specific milestone, input the desired number of years.

2. Current Net Worth:

Enter your current financial standing, including savings, investments, and any other assets. This provides the baseline for your future projections.

3. Expected Annual Return:

Specify the anticipated annual return on your investments. This figure helps the calculator estimate the growth of your portfolio over time.

4. Additional Contribution:

Input any additional funds you plan to contribute regularly. You can choose the frequency, whether monthly or annually, depending on your financial habits.

5. Contribution Growth (Percent and Frequency):

Define the growth rate for your additional contributions. This feature allows you to account for salary increases, bonuses, or other financial increments. Choose whether this growth occurs year over year or month over month.

Executing the Calculation:

Once you've entered all the necessary information, click on the "Calculate" button. The Portseido Free Online Fire Calculator will process your inputs and generate a comprehensive set of outputs to guide your financial planning.

Understanding the Outputs:

1. Final Goal:

The calculator will display the projected final goal amount in dollars. This represents the target amount you aim to achieve within the specified time horizon.

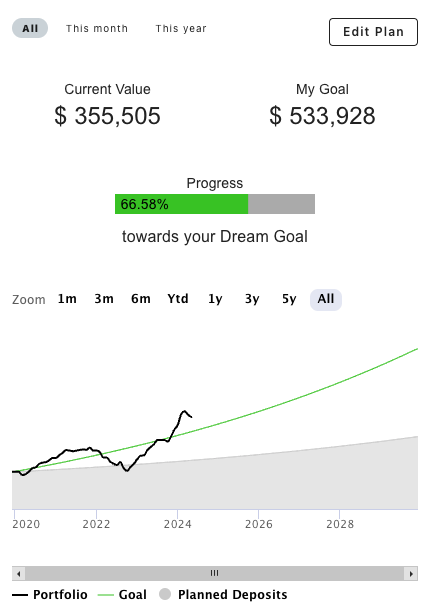

2. Portfolio Projection Graph:

Visualize your portfolio's projected growth over time with an easy-to-understand graph. This graphical representation provides a quick overview of your financial trajectory.

3. Portfolio Projection Table:

Explore a detailed table that breaks down your portfolio progression over the specified time horizon. The table includes multiple tabs for "Value," "Contribution," and "Return," allowing you to analyze each aspect of your financial plan.